Lesson 1:Why Trade Forex

Online forex trading has become very popular in the past decade because it offers traders several advantages:

FOREX NEVER SLEEPS

Trading goes on all around the world during different countries’ “business hours”.

You can, therefore, trade major currencies at any time, 24 hours a day.

Since there are no set exchange hours, it means that there is also something happening at almost any time of the day or night.

GO LONG OR SHORT

Unlike many other financial markets, where it can be difficult to sell short, there are no limitations on shorting currencies.

If you think a currency will go up, buy it.

If you think it will fall, sell it. This means there is no such thing as a “bear market” in forex you can make money at any time.

LOW TRADING COSTS

Most forex accounts trade without any commission and there are no expensive exchange fees or data licenses.

The cost of trading is simply the spread between the buy price and the sell price.

This Spread is always displayed on your trading screen, making it easy to monitor your Costs of Trading.

UNMATCHED LIQUIDITY

Because forex is a $4 trillion a day market, with most trading concentrated in only a few currencies, there are always a lot of people trading.

This makes it typically very easy to get in and out of trades at any time, even in large sizes.

AVAILABLE LEVERAGE

Because of the deep liquidity available in the forex market, you can trade forex with considerable leverage (up to 1:400).

This will allow you to even take advantage of merest movements in the market.

Hence, Leverage can significantly increase your profit.

INTERNATIONAL EXPOSURE

As the world becomes more and more global, investors are hunting for opportunities anywhere they can.

If you want to take a broad opinion and invest in another country (or sell short!), forex is an easy way to gain exposure while avoiding risks through foreign securities laws and financial statements in other languages.

Basic Concepts

Learning to trade in a new market is like learning to speak a new language.

It’s easier when you have a good vocabulary and understand some basic ideas and concepts.

So let’s start with the basics of forex trading before moving on to learn how to use the MT4.

Forex is a commonly used abbreviation for “foreign exchange”.

It mainly describes the buying and selling of a currency in the foreign exchange market, especially by investors and speculators.

The familiar expression, “buy low and sell high,” certainly applies to currency trading.

HOW DO YOU READ A QUOTE?

Because you are always comparing one currency to another, forex is quoted in pairs.

This may seem confusing at first, but it is actually pretty straightforward. For example, the EUR/USD at 1.4022 shows how much one euro (EUR) is worth in U.S. dollars (USD).

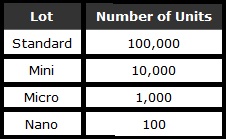

WHAT IS A LOT?

A Micro lot is the smallest tradable size available (Volume = 0.01).

GSI Markets accounts have a standardized lot size of 100,000 units of currency (Volume = 1.00).

Account holders can however place trades of different sizes, as long as they are in increments of 1,000 units like, 2,000, 3,000, 15,000 and 112,000.

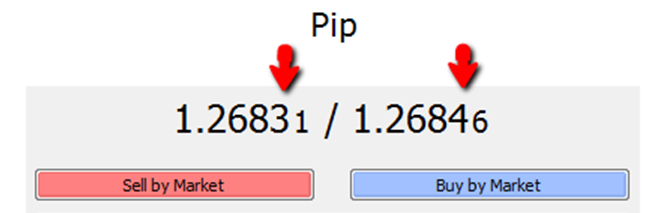

WHAT IS A PIP?

A pip is the unit you count as a profit or a loss.

Most currency pairs, except Japanese yen pairs, are quoted to four decimal places.

This fourth spot after the decimal point is typically what one watches to count “pips”.

Every point that is placed in the quote moves is 1 pip of movement.

For example, if the EUR/USD rises from 1.4022 to 1.4027, the EUR/USD has rosen by 5 pips.

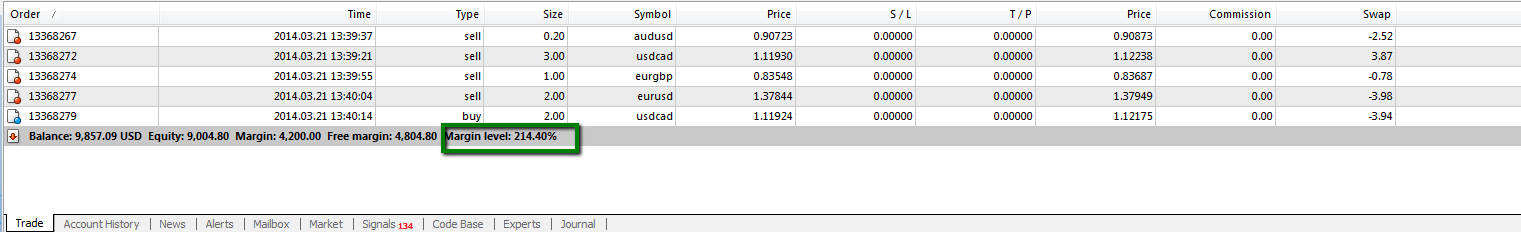

WHAT IS LEVERAGE/MARGIN?

As mentioned before, all trades are executed using borrowed money.

This allows you to use the advantage of Leverage.

A Leverage of 400:1 allows you to trade with $400,000 in the market by setting aside only $1000 as a security deposit.

This means that you can take advantage of even the smallest movements in the currency market by controlling more money in the market than you have in your account, while limiting your losses to the deposit you made.

Moreover, leverage significantly increases your profits.

The specific amount that you are required to put aside to hold a position is referred to as your Margin Requirement.

Margin can be thought of as a good faith deposit required maintaining open positions.

This is not a fee or a transaction cost, it is simply a portion of your account equity set aside and located as a Margin Deposit.