Highly Effective Trading Indicators

Leonardo da Vinci once said, ‘Simplicity is the ultimate sophistication’, and that phrase could not be any truer to Forex traders today. When starting out, most Forex traders usually go for complicated trading strategies that utilize complex indicators. But as they continue their trading journey, they come to the realization that a simple strategy is usually the best as it eliminates the problem of analysis paralysis and allows for quick reactions in the dynamic Forex market. Such strategies utilize the common technical analysis tools, yet highly effective trading indicators.

Here are some of them:

Moving Averages

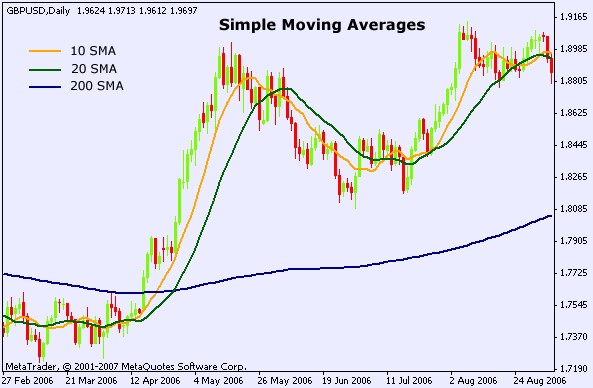

One of the oldest technical analysis tools, Moving Averages (MAs) are highly effective trading indicators that help traders determine trend direction, trend momentum as well as confirm trend reversals. Trend direction can be easily determined by a quick glance at a chart. If prices are above a MA line, the market is in an uptrend and traders should seek opportunities to place Buy orders; if prices are below a MA line, the market is in a downtrend and traders should seek opportunities to place Sell orders in the market.

To determine the momentum of trend, traders simply look at the slope of the MA - the steeper the MA, the more momentous the trend, and vice versa. Determining trend momentum in Forex is very important especially to short term traders who want to take out their profits as fast as possible. For such traders, it is always advisable to place trades only in momentous markets.

MAs are not only useful in trending markets, they can also help traders confirm definitively that the dominant trend has ended. To confirm trend reversals, traders use multiple MAs and watch out for a crossover. For instance, when the dominant trend is up, and the faster MA crosses the slower MA downwards, it would be a confirmation that a downtrend is now in place.

Trendlines

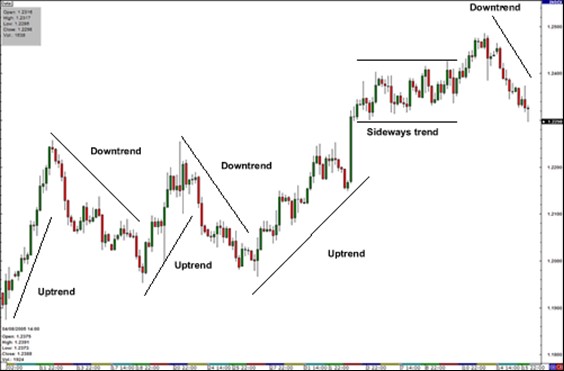

‘The trend is your friend’ is a common axiom in the financial markets. Basically, it means that if you always place trades that are in tandem with the prevailing market conditions, you will literally be safe. That is why trendlines have stood the test of time and are always considered one of the most highly effective trading indicators. To ensure their efficiency, traders must draw them correctly on their charts. As a rule, trendlines are drawn connecting two or more asset price highs or lows and projecting the line into the future. It is the projected line that serves as a guide for traders, with traders picking out quality trading opportunities when future prices come at or near it. Trendlines are extremely versatile and can help traders find profitable opportunities in any market condition.

Stochastics

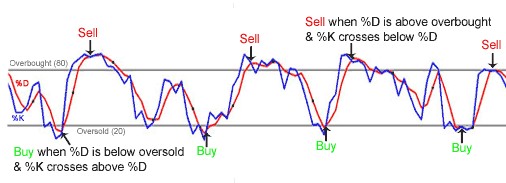

Another one of the most highly effective trading indicators, Stochastics, is an oscillator that helps Forex traders spot quality trade opportunities in the endless price cycles in the market. As an oscillator, it helps traders determine overbought or oversold conditions in the market. The stochastic indicator has two lines (one faster than the other) that oscillate between values of 0-100. Oversold conditions denote waning bearish momentum and are determined when the lines are below the ‘20’ level. In oversold conditions, traders will place Buy orders when the faster line crosses the slower line upwards. Similarly, overbought conditions denote waning bullish momentum and are determined when the lines are above the ‘80’ level. In overbought conditions, traders will place Sell orders when the faster line crosses the slower line downwards.

Stochastics can also help in qualifying prevailing trends. This is done by observing the centerline (level ‘50’). Simply, a stochastic reading above ‘50’ implies that bullish momentum is likely to be sustained; while below ‘50’ implies that bearish momentum is likely to continue.

Final Word

The above technical analysis tools are simple and easy to decipher, yet they have proven over time to be highly effective trading indicators. By learning and understanding more about their mechanics, Forex traders will be able to consistently pick out quality trading opportunities in the market.