Lesson 6:Japanese Candlestick

What is a Japanese Candlestick?

While we briefly covered forex candlestick charting analysis in the previous lesson, we’ll now dig in a little and discuss them more in detail.

Let’s do a quick review first.

What is Forex Candlestick Trading?

Back in the day when Godzilla was still a cute little lizard, the Japanese created their own old school version of technical analysis to trade rice.

That’s right, rice.

A westerner by the name of Steve Nison “discovered” this secret technique called “Japanese candlesticks”, learning it from a fellow Japanese broker.

Steve researched, studied, lived, breathed, ate candlesticks, and began to write about it. Slowly, this secret technique grew in popularity in the 90s.

To make a long story short, without Steve Nison, candlestick charts might have remained a buried secret. Steve Nison is Mr. Candlestick.

Okay, so what the heck are forex candlesticks?

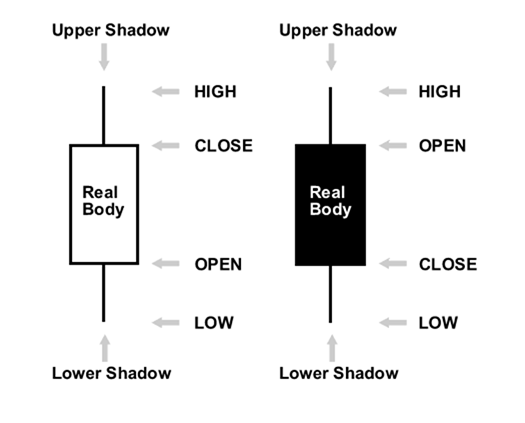

The best way to explain is by using a picture:

Forex candlesticks can be used for any time frame, whether it be one day, one hour, 30-minutes – whatever you want! They are used to describe the price action during the given time frame.

Candlesticks are formed using the open, high, low, and close of the chosen time period.

- If the close is above the open, then a hollow candlestick (usually displayed as white) is drawn.

- If the close is below the open, then a filled candlestick (usually displayed as black) is drawn.

- The hollow or filled section of the candlestick is called the “real body” or body.

- The thin lines poking above and below the body display the high/low range and are called shadows.

- The top of the upper shadow is the “high”.

- The bottom of the lower shadow is the “low”.

Basic Forex Candlestick Patterns

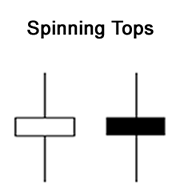

Spinning Tops

Candlesticks with a long upper shadow, long lower shadow and small real bodies are called spinning tops. The color of the real body is not very important.

The pattern indicates the indecision between the buyers and sellers.

The small real body (whether hollow or filled) shows little movement from open to close, and the shadows indicate that both buyers and sellers were fighting but nobody could gain the upper hand.

Even though the session opened and closed with little change, prices moved significantly higher and lower in the meantime.

Neither buyers nor sellers could gain the upper hand, and the result was a standoff.

If a spinning top forms during an uptrend, this usually means there aren’t many buyers left and a possible reversal in direction could occur.

If a spinning top forms during a downtrend, this usually means there aren’t many sellers left and a possible reversal in direction could occur.

Marubozu

Sounds like some kind of voodoo magic, huh? “I will cast the evil spell of the Marubozu on you!” Fortunately, that’s not what it means.

Marubozu means there are no shadows from the bodies. Depending on whether the candlestick’s body is filled or hollow, the high and low are the same as its open or close.

Check out the two types of Marubozus in the picture below.

A White Marubozu contains a long white body with no shadows.

The open price equals the low price and the close price equals the high price.

This is a very bullish candle as it shows that buyers were in control the entire session. It usually becomes the first part of a bullish continuation or a bullish reversal pattern.

A Black Marubozu contains a long black body with no shadows.

The open equals the high and the close equals the low.

This is a very bearish candle as it shows that sellers controlled the price action the entire session. It usually implies bearish continuation or bearish reversal.

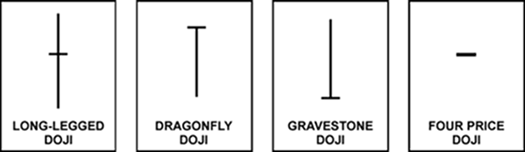

Doji

Doji candlesticks have the same open and close price or at least their bodies are extremely short.

A doji should have a very small body that appears as a thin line.

Doji candles suggest indecision or a struggle for turf positioning between buyers and sellers.

Prices move above and below the open price during the session, but close at or very near the open price.

Neither buyers nor sellers were able to gain control and the result was essentially a draw.

There are four special types of Doji candlesticks.

The length of the upper and lower shadows can vary and the resulting candlestick looks like a cross, inverted cross or plus sign.

The word “Doji” refers to both the singular and plural form.

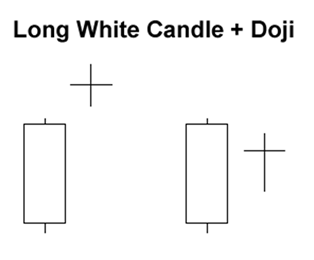

When a Doji forms on your chart, pay special attention to the preceding candlesticks.

If a Doji forms after a series of candlesticks with long hollow bodies (like White Marubozus), the Doji signals that the buyers are becoming exhausted and weakening.

In order for price to continue rising, more buyers are needed but there aren’t anymore! Sellers are licking their chops and are looking to come in and drive the price back down.

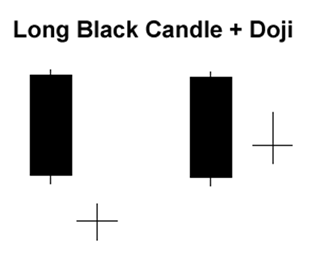

If a Doji forms after a series of candlesticks with long filled bodies (like Black Marubozus), the Doji signals that sellers are becoming exhausted and weak.

In order for price to continue falling, more sellers are needed but sellers are all tapped out! Buyers are foaming in the mouth for a chance to get in cheap.

While the decline is sputtering due to lack of new sellers, further buying strength is required to confirm any reversal.

Look for a white candlestick to close above the long black candlestick’s open.

In the next following sections, we will take a look at specific candlestick formations and what they are telling us.

Hopefully, by the end of this lesson on candlesticks, you would know how to recognize different types of candlestick patterns and make sound trading decisions based on them.

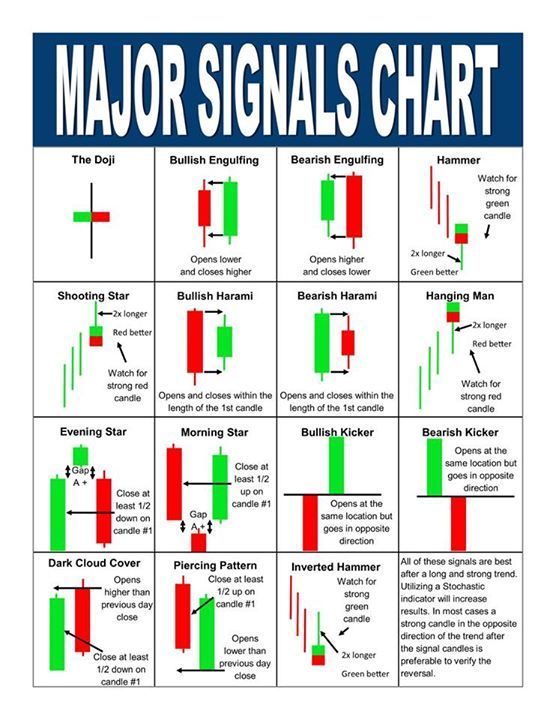

Japanese Candlesticks Cheat Sheet

Did you click here first? If you did, stop reading right now and go through the entire Japanese Candlesticks Lesson first!

If you’re REALLY done with those, here’s quick one page reference cheat sheet for single, dual, and triple candlestick formations to easily identify what kind of pattern you are looking at whenever you are trading.