Forex rates

Understanding Forex Rates and Spreads

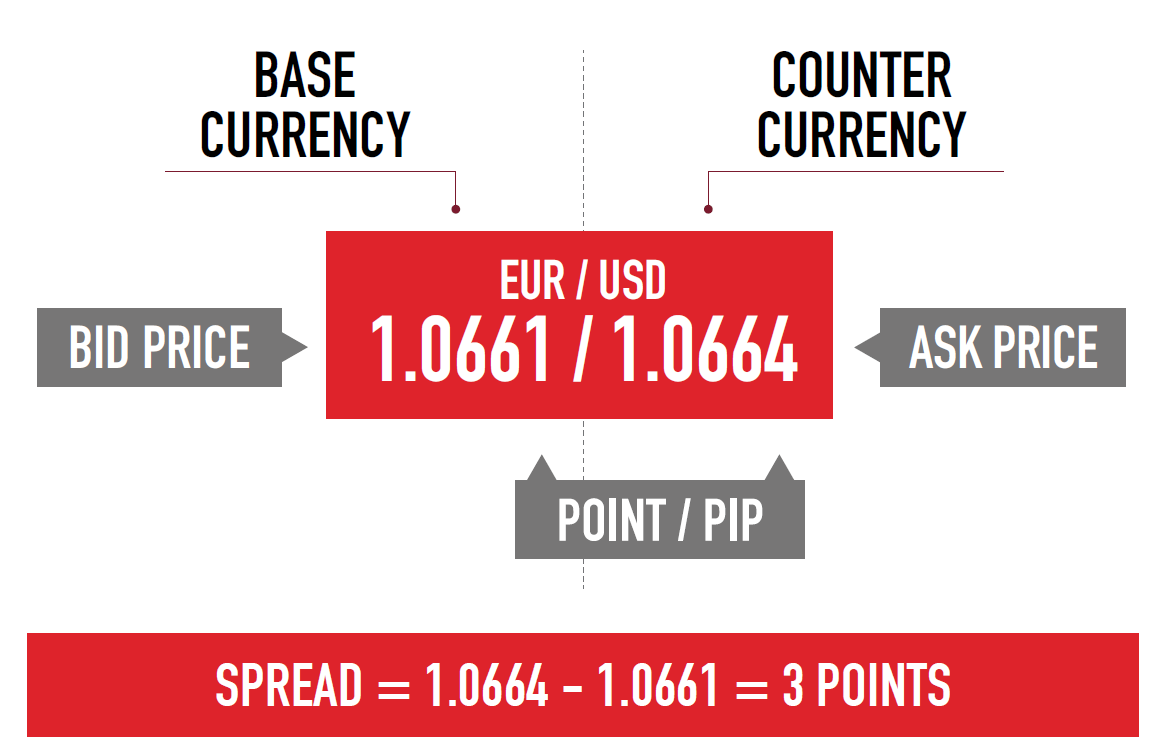

Forex rates usually depict the relationship between one currency and another; ultimately, what is traded in the Forex market is simply money. Because Forex trading involves the simultaneous buying and selling of currencies, prices are usually quoted in pairs. All Forex rates usually include a two-way price, the bid and ask prices.

Understanding Bid, Ask and Spread

As stated earlier, Forex rates are always expressed as bid/ask. The bid is always lower than the ask price. The bid is the price the broker is willing to buy the base currency in exchange for the counter currency. This is the price at which traders sell. The ask is the price at which the broker is willing to sell the base currency in exchange for the counter currency. This is the price at which traders buy. The spread is the difference between the bid and ask price; and to Forex traders, this is the cost of placing a trade in the market.

Take the Forex rate above: the Base currency is the euro (EUR), while the Counter currency is the US dollar (USD). The bid price is 1.0661, while the ask price is 1.0664, and the difference between the two quotes is 3 points. This means that the spread is 3 pips. Thus, the transaction cost of opening a EURUSD trade is 3 pips. If one is trading with a standard lot size, where one pip equals $10, the cost of opening a EURUSD trade will be $30.

Traders need to always scrutinize the Forex rates so as to keep track of their trading costs. This is because in most brokerage firms, spreads are variable. It is always important to trade when the spread is as minimal as possible, because we are in this to make money; and this means keepings costs as low as possible.

Why Spreads Vary

The major determinant of the bid-ask spread in Forex is liquidity. Liquid currencies will always have narrow spreads, while illiquid currencies will always have wider spreads. Liquid currencies are the major currencies (such as the USD), while the exotics (such as the South African rand) are mostly illiquid. But there are other factors that may affect liquidity, and these factors also have an impact on the bid-ask spread.

Market conditions can have an effect on currency liquidity. In high volatile markets, investors usually shy away from the markets and spreads may widen in most currencies, even the majors. This may happen during the release of high impact macroeconomic data, such as US Nonfarm payrolls. In medium or low volatile markets, the spreads are usually narrower and not prone to fluctuations.

Trading times can also have an impact on liquidity, and thus spreads on Forex rates. The Forex markets run around the clock, but this does not mean traders should trade all the time. Particularly, trading during the Asian session (0000hrs-0900hrs GMT) is not advised for day traders or any other types of traders that watch the spread. Spreads are usually wider during these times because of the small number of participants in the market. One of the best times to trade is between 1300hrs and 1700hrs GMT when the London market and the New York market overlap.

Conclusion

It is always important to examine the Forex rates displayed by your broker before opening a trade. This is because spreads are not constant, but keep changing sporadically. Applying an efficient spread management plan can help control one’s trading costs as well as enhance one’s profitability.